BrownianBridgeProcess[σ,{t1,a},{t2,b}]

represents the Brownian bridge process from value a at time t1 to value b at time t2 with volatility σ.

BrownianBridgeProcess[{t1,a},{t2,b}]

represents the standard Brownian bridge process from value a at time t1 to value b at time t2.

BrownianBridgeProcess[t1,t2]

represents the standard Brownian bridge process pinned at 0 at times t1 and t2.

represents the standard Brownian bridge process pinned at 0 at time 0 and at time 1.

BrownianBridgeProcess

BrownianBridgeProcess[σ,{t1,a},{t2,b}]

represents the Brownian bridge process from value a at time t1 to value b at time t2 with volatility σ.

BrownianBridgeProcess[{t1,a},{t2,b}]

represents the standard Brownian bridge process from value a at time t1 to value b at time t2.

BrownianBridgeProcess[t1,t2]

represents the standard Brownian bridge process pinned at 0 at times t1 and t2.

represents the standard Brownian bridge process pinned at 0 at time 0 and at time 1.

Details

- BrownianBridgeProcess is also known as pinned Brownian motion process.

- BrownianBridgeProcess is a continuous-time and continuous-state random process.

- The state

for a Brownian bridge process satisfies

for a Brownian bridge process satisfies  and

and  .

. - The state

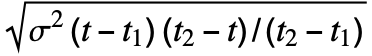

follows NormalDistribution[a+(b-a) (t-t1)/(t2-t1),

follows NormalDistribution[a+(b-a) (t-t1)/(t2-t1), ].

]. - The parameters σ, t1, t2, a, and b can be any real numbers, with σ positive and t2 greater than t1.

- BrownianBridgeProcess can be used with such functions as Mean, PDF, Probability, and RandomFunction.

Examples

open all close allBasic Examples (3)

Scope (13)

Basic Uses (8)

Process Slice Properties (5)

Univariate SliceDistribution:

First-order probability density function:

Multivariate slice distribution:

Second-order PDF:

Compute the expectation of an expression:

Calculate the probability of an event:

Skewness and kurtosis are constant:

CentralMoment and its generating function:

FactorialMoment has no closed form for symbolic order:

Cumulant and its generating function:

Properties & Relations (9)

A Brownian bridge is not weakly stationary:

A Brownian bridge process does not have independent increments:

Compare to the product of expectations:

Conditional cumulative probability distribution:

A Brownian bridge process is a special ItoProcess:

As well as StratonovichProcess:

A Brownian bridge process is a solution to the stochastic differential equation ![]() :

:

Compare with the corresponding smooth solution:

A Brownian bridge process initially follows its corresponding WienerProcess:

The distribution of the absolute supremum of a BrownianBridgeProcess follows a Kolmogorov distribution:

Compare the cumulative histogram with the cumulative distribution function of a Kolmogorov distribution:

BrownianBridgeProcess can be simulated directly from WienerProcess:

Apply a transformation to the random sample:

Compare to the corresponding BrownianBridgeProcess:

A Brownian bridge is a conditioned WienerProcess:

Compare to the CDF of the slice distribution of a Brownian bridge:

Possible Issues (1)

Neat Examples (3)

Related Guides

History

Text

Wolfram Research (2012), BrownianBridgeProcess, Wolfram Language function, https://reference.wolfram.com/language/ref/BrownianBridgeProcess.html.

CMS

Wolfram Language. 2012. "BrownianBridgeProcess." Wolfram Language & System Documentation Center. Wolfram Research. https://reference.wolfram.com/language/ref/BrownianBridgeProcess.html.

APA

Wolfram Language. (2012). BrownianBridgeProcess. Wolfram Language & System Documentation Center. Retrieved from https://reference.wolfram.com/language/ref/BrownianBridgeProcess.html

BibTeX

@misc{reference.wolfram_2025_brownianbridgeprocess, author="Wolfram Research", title="{BrownianBridgeProcess}", year="2012", howpublished="\url{https://reference.wolfram.com/language/ref/BrownianBridgeProcess.html}", note=[Accessed: 09-March-2026]}

BibLaTeX

@online{reference.wolfram_2025_brownianbridgeprocess, organization={Wolfram Research}, title={BrownianBridgeProcess}, year={2012}, url={https://reference.wolfram.com/language/ref/BrownianBridgeProcess.html}, note=[Accessed: 09-March-2026]}