ItoProcess

ItoProcess[{a,b},x,t]

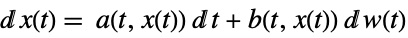

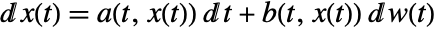

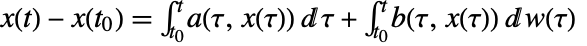

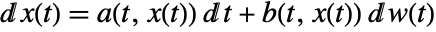

represents an Ito process ![]() , where

, where ![]() .

.

ItoProcess[{a,b,c},x,t]

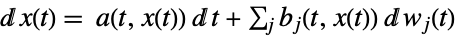

represents an Ito process ![]() , where

, where ![]() .

.

ItoProcess[…,{x,x0},{t,t0}]

uses initial condition ![]() .

.

ItoProcess[…,…,…,Σ]

uses a Wiener process ![]() , with covariance Σ.

, with covariance Σ.

ItoProcess[proc]

converts proc to a standard Ito process whenever possible.

ItoProcess[sdeqns,expr,x,t,wdproc]

represents an Ito process specified by a stochastic differential equation sdeqns, output expression expr, with state x and time t, driven by w following the process dproc.

Details and Options

- ItoProcess is also known as Ito diffusion or stochastic differential equation (SDE).

- ItoProcess is a continuous-time and continuous-state random process.

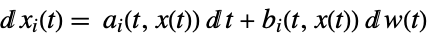

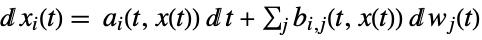

- If the drift a is an

-dimensional vector and the diffusion b an

-dimensional vector and the diffusion b an  ×

× -dimensional matrix, the process is

-dimensional matrix, the process is  -dimensional and driven by an

-dimensional and driven by an  -dimensional WienerProcess.

-dimensional WienerProcess. - Common specifications for coefficients a and b include:

-

a scalar, b scalar

a scalar, b vector

a vector, b vector

a vector, b matrix

- A stochastic differential equation

is sometimes written as an integral equation

is sometimes written as an integral equation  .

. - The default initial time t0 is taken to be zero, and the default initial state x0 is zero.

- The default covariance Σ is the identity matrix.

- For a general covariance Σ, ItoProcess canonicalizes the process by converting the diffusion matrix b to b.Σ1/2, with Σ1/2 the lower Cholesky factor of Σ when possible. »

- A standard Ito process has output

, consisting of a subset of differential states

, consisting of a subset of differential states  .

. - Processes proc that can be converted to standard ItoProcess form include OrnsteinUhlenbeckProcess, GeometricBrownianMotionProcess, StratonovichProcess, and ItoProcess.

- Converting an ItoProcess to standard form automatically makes use of Ito's lemma.

- The stochastic differential equations in sdeqns can be of the form

, where

, where  is \[DifferentialD], which can be input using

is \[DifferentialD], which can be input using  dd

dd . The differentials

. The differentials  and

and  are taken to be Ito differentials.

are taken to be Ito differentials. - The output expression expr can be any expression involving x[t] and t.

- The driving process dproc can be any process that can be converted to a standard Ito process.

- Properties related to ItoProcess include:

-

"Drift" drift term "Diffusion" diffusion matrix "Output" output state "TimeVariable" time variable "TimeOrigin" origin of time variable "StateVariables" state variables "InitialState" initial state values "KolmogorovForwardEquation" Kolmogorov forward equation (Fokker-Planck equation) "KolmogorovBackwardEquation" Kolmogorov backward equation "Derivative" Ito derivative "FeynmanKacFormula" PDE obtained from Feynman-Kac formula - Method settings in RandomFunction specific to ItoProcess include: »

-

"EulerMaruyama" Euler–Maruyama (order 1/2, default) "KloedenPlatenSchurz" Kloeden–Platen–Schurz (order 3/2) "Milstein" Milstein (order 1) "StochasticRungeKutta" 3‐stage Rossler SRK scheme (order 1) "StochasticRungeKuttaScalarNoise" 3‐stage Rossler SRK scheme for scalar noise (order 3/2) - ItoProcess can be used with such functions as RandomFunction, CovarianceFunction, PDF, and Expectation.

Examples

open allclose allBasic Examples (1)

Scope (19)

Basic Uses (10)

Define a Wiener process with drift ![]() and diffusion

and diffusion ![]() from the stochastic differential equation (SDE)

from the stochastic differential equation (SDE) ![]() :

:

Directly convert from the parametric process:

Use differential notation to define the same process:

Define a vector process ![]() with output

with output ![]() :

:

Define a vector process ![]() , where

, where ![]() :

:

Define a vector process ![]() where

where ![]() :

:

Define a process driven by two correlated Wiener processes:

The canonicalized process has diffusion matrix equal to ![]() , with

, with ![]() the diffusion matrix before canonicalization:

the diffusion matrix before canonicalization:

Define a scalar process ![]() corresponding to the SDE

corresponding to the SDE ![]() :

:

Define vector process ![]() and

and ![]() corresponding to the SDE

corresponding to the SDE ![]() and

and ![]() :

:

Define a process corresponding to the 2D correlated Wiener process:

Define vector process driven by correlated 2D Wiener process:

Simulate ItoProcess paths using different methods:

Simulation methods and their corresponding orders:

Specify the simulation method as an option in RandomFunction:

Process Properties Extraction (2)

Define an Ito process by its stochastic differential equation:

Available Ito process properties:

Drift and diffusion of the process:

Inactive is used here to avoid expanding the partial derivatives; use Activate to expand the expression:

Compute the Ito derivative of a function ![]() . The output is a list consisting of drift and diffusion terms:

. The output is a list consisting of drift and diffusion terms:

The property "FeynmanKacFormula" gives a PDE whose solution ![]() satisfies the conditional expectation

satisfies the conditional expectation ![]() and terminal condition

and terminal condition ![]() :

:

Additional arguments can be provided for the generalized situations. With an additional argument ![]() , the property "FeynmanKacFormula" gives a PDE whose solution satisfies the conditional expectation

, the property "FeynmanKacFormula" gives a PDE whose solution satisfies the conditional expectation ![]() and the same terminal condition:

and the same terminal condition:

With a third argument ![]() , the property "FeynmanKacFormula" gives a PDE whose solution satisfies the conditional expectation

, the property "FeynmanKacFormula" gives a PDE whose solution satisfies the conditional expectation ![]() and the same terminal condition:

and the same terminal condition:

Define Heston model with ItoProcess:

Special Ito Processes (5)

An Ito process corresponding to the WienerProcess:

An Ito process corresponding to the GeometricBrownianMotionProcess:

An Ito process corresponding to the BrownianBridgeProcess:

An Ito process corresponding to the OrnsteinUhlenbeckProcess:

An Ito process corresponding to the CoxIngersollRossProcess:

Process Slice Properties (2)

Define Jacobi diffusion process:

Compute low-order cumulants of time‐slice distribution:

Find the limit of infinite time horizon:

Compare with cumulants of the uniform distribution:

Define a vector process given by a system of linear SDEs:

Find the probability density function of the time‐slice distribution:

Applications (11)

Computing Properties (3)

Compute cross-covariance of the Ornstein–Uhlenbeck process ![]() and its underlying Wiener process

and its underlying Wiener process ![]() :

:

Compute moments of the process ![]() , where

, where ![]() is the standard Wiener process:

is the standard Wiener process:

Vector Ito process driven by scalar noise (1D oscillator driven by white noise):

Compute mean and variance functions:

Plot mean function and the standard deviation band, together with generated paths:

Martingales (3)

Determine values of ![]() and

and ![]() for which the process

for which the process ![]() is a martingale, where

is a martingale, where ![]() is the standard Wiener process:

is the standard Wiener process:

Zero drift coefficient of the standard form is a necessary condition for ![]() to be a martingale:

to be a martingale:

Scalar Ito process driven by vector Wiener process:

Define the same process via a stochastic equation:

Construct a scalar process driven by two Wiener processes:

By Lévy characterization, ![]() is a Brownian motion. The mean of the process is the same as the initial state:

is a Brownian motion. The mean of the process is the same as the initial state:

Modeling (2)

The dynamics of a free particle under the effect of thermal fluctuation can be modeled by the Langevin equation of motion, ![]() , where

, where ![]() is the standard WienerProcess and

is the standard WienerProcess and ![]() is the strength of the thermal noise. Here it is assumed that

is the strength of the thermal noise. Here it is assumed that ![]() can only depend on

can only depend on ![]() and focus on the equation of velocity. There are two common ways to integrate the equation of motion: Ito formulation and Stratonovich formulation. They can be defined via:

and focus on the equation of velocity. There are two common ways to integrate the equation of motion: Ito formulation and Stratonovich formulation. They can be defined via:

When ![]() is a constant, the two formulations are identical and lead to the same stationary distribution as

is a constant, the two formulations are identical and lead to the same stationary distribution as ![]() :

:

If ![]() is velocity dependent, then due to the nature of the WienerProcess,

is velocity dependent, then due to the nature of the WienerProcess, ![]() has nonzero quadratic variation and the two formulations lead to different results. Convert Stratonovich formulation to the equivalent Ito formulation:

has nonzero quadratic variation and the two formulations lead to different results. Convert Stratonovich formulation to the equivalent Ito formulation:

The drift under Stratonovich formulation is different from the drift under Ito formulation:

The Gompertz curve is typically used in the modeling of a growth process, such as tumor growth. By assuming Gaussian noise in the logarithm of the growth process, you can write the model as a stochastic differential equation:

Mean of the process is the usual Gompertz curve:

Slice distribution of the process at time ![]() obeys LogNormalDistribution:

obeys LogNormalDistribution:

Simulate the process with ![]() , and

, and ![]() from

from ![]() to

to ![]() :

:

Generate a thousand samples with the same conditions, then visualize the paths and slice data at ![]() :

:

Ito Process Representations (3)

Use ItoProcess to represent the standard WienerProcess:

![]() is a martingale. Use Ito lemma to compute the derivative of

is a martingale. Use Ito lemma to compute the derivative of ![]() :

:

Create a CoxIngersollRossProcess and represent it with ItoProcess:

Obtain Kolmogorov forward equation:

Solve the equation numerically in ![]() with a localized initial condition at

with a localized initial condition at ![]() and Dirichlet boundary conditions:

and Dirichlet boundary conditions:

Plot the solution of Kolmogorov forward equation at ![]() and compare it with the closed-form density function:

and compare it with the closed-form density function:

Visualize the dynamic of the solution with Animate:

Represent a GeometricBrownianMotionProcess with ItoProcess, where ![]() represents the risk-free interest rate and

represents the risk-free interest rate and ![]() is the volatility:

is the volatility:

Compute Ito differential for a discounted process ![]() :

:

The classical Black–Scholes equation can be obtained by equating the drift to 0 with some simplifications:

The equation can be also obtained directly from the Feynman–Kac formula:

Solve the Black–Scholes equation symbolically with DSolve:

Properties & Relations (2)

Convert StratonovichProcess to ItoProcess:

Transformed Wiener processes are related to ItoProcess:

Possible Issues (2)

ItoProcess does not support random initial conditions, so cannot be represented:

But it supports processes with fixed initial condition:

Initial time of the driven process needs to match with ItoProcess:

Text

Wolfram Research (2012), ItoProcess, Wolfram Language function, https://reference.wolfram.com/language/ref/ItoProcess.html (updated 2016).

CMS

Wolfram Language. 2012. "ItoProcess." Wolfram Language & System Documentation Center. Wolfram Research. Last Modified 2016. https://reference.wolfram.com/language/ref/ItoProcess.html.

APA

Wolfram Language. (2012). ItoProcess. Wolfram Language & System Documentation Center. Retrieved from https://reference.wolfram.com/language/ref/ItoProcess.html